From Appointment to Action: A Connected Experience with NPC

Most banks and credit unions use tools like appointment booking, lobby management, or even workforce scheduling. These tools help. They make life a little easier. But on their own, they don’t guarantee what matters most to productivity: Data Continuity. From when a customer walks in (or logs in) to completion of the service – everything must flow like a choreographed event. An end-to-end workflow.

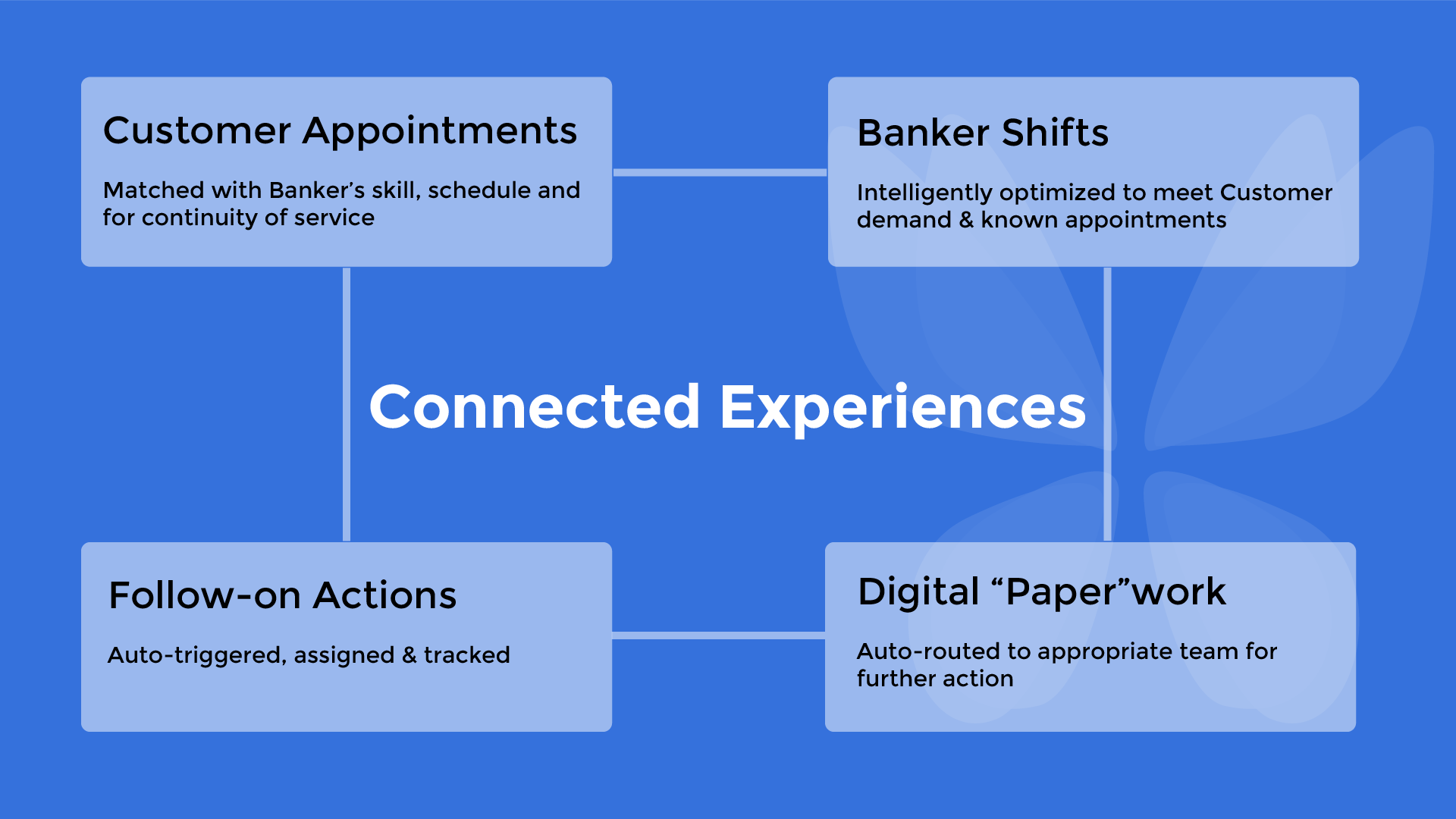

NPC’s combination of otherwise disparate appointment booking, workforce management, task management and workflow-driven forms into a single cohesive platform transforms the branch productivity landscape.

1. Aligning Demand with Supply

Appointment booking systems give banks a forward-looking view of customer demand. They show who is coming in, when, and for what. Workforce management ensures that the right associates — with the right skills and certifications — are scheduled to meet that demand.

2. Guaranteeing Continuity of Service

With NPC, bankers capture session outcomes in structured Forms. These aren’t just static notes — they’re workflows. Each form is automatically routed to the right team in the bank, whether it’s credit, compliance, or operations. Mortgage applications move directly into underwriting. Account maintenance requests flow straight to back-office teams. Compliance checklists get logged, tracked, and escalated if needed. The result: no loose ends, no missed follow-ups, no customer repeating themselves.

3. Handling Walk-Ins Without Chaos

When appointment data and workforce schedules are integrated, branch leaders can pivot staff between appointments and lobby management. NPC Forms ensure that even walk-in requests are documented, tracked, and routed — so nothing “slips through the cracks.”

4. Protecting Compliance and Accountability

For regulated services — mortgages, IRAs, investment accounts — it’s not enough to have someone “available.” They must be qualified and certified. NPC Appointment booking ensures only trained staff are offered to customers. Workforce management ensures those staff are actually on the schedule. NPC Forms ensure everything that happens in the session is recorded and routed with a full audit trail.

That’s how banks achieve continuity + compliance + accountability.

5. Strengthening Customer Relationships

Customers value continuity not just for efficiency, but for trust. Seeing the same associate, or at least an associate who knows their history, makes banking feel personal. NPC supports that continuity by Routing returning customers to their previous banker when possible and ensuring all session notes and actions are captured in structured workflows, so even if a different associate steps in, they have the full context. The customer experience goes from transactional to personalized and consistent.

6. The Closed Loop

Appointments, Schedules, Tasks & Forms feed data to each other. Appointment volumes improve workforce forecasting. Workforce scheduling data helps refine appointment slot availability. And Forms highlight bottlenecks, common escalations, and team performance. The loop continuously improves, giving banks real intelligence about how to better serve their customers.

“

The Bottom Line

Banks and credit unions don’t win trust with point tools. Appointment booking alone is helpful. Workforce scheduling is useful. Forms and checklists are necessary.

But when they work together as a single platform, they transform how branches operate.

- Appointment booking = the customer promise

- Workforce management = delivering that promise

- NPC Forms = ensuring the promise continues after the branch visit

That’s the difference between tools that “help” operations… and a platform that transforms them.